change in net working capital formula dcf

The last step is to find the change in net working capital. Change in Net Working Capital 5000.

Change In Working Capital Video Tutorial W Excel Download

If youre asking whether you include cash in the CA to get to change in net working capital the answer is no.

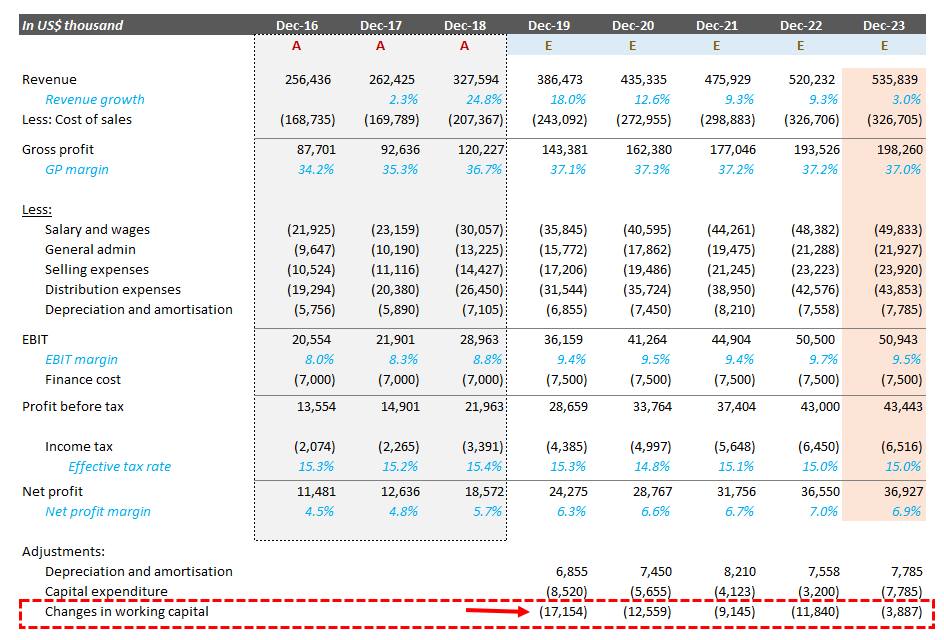

. The logic behind subtracting net working capital is as such. If a transaction increases current assets and. Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital.

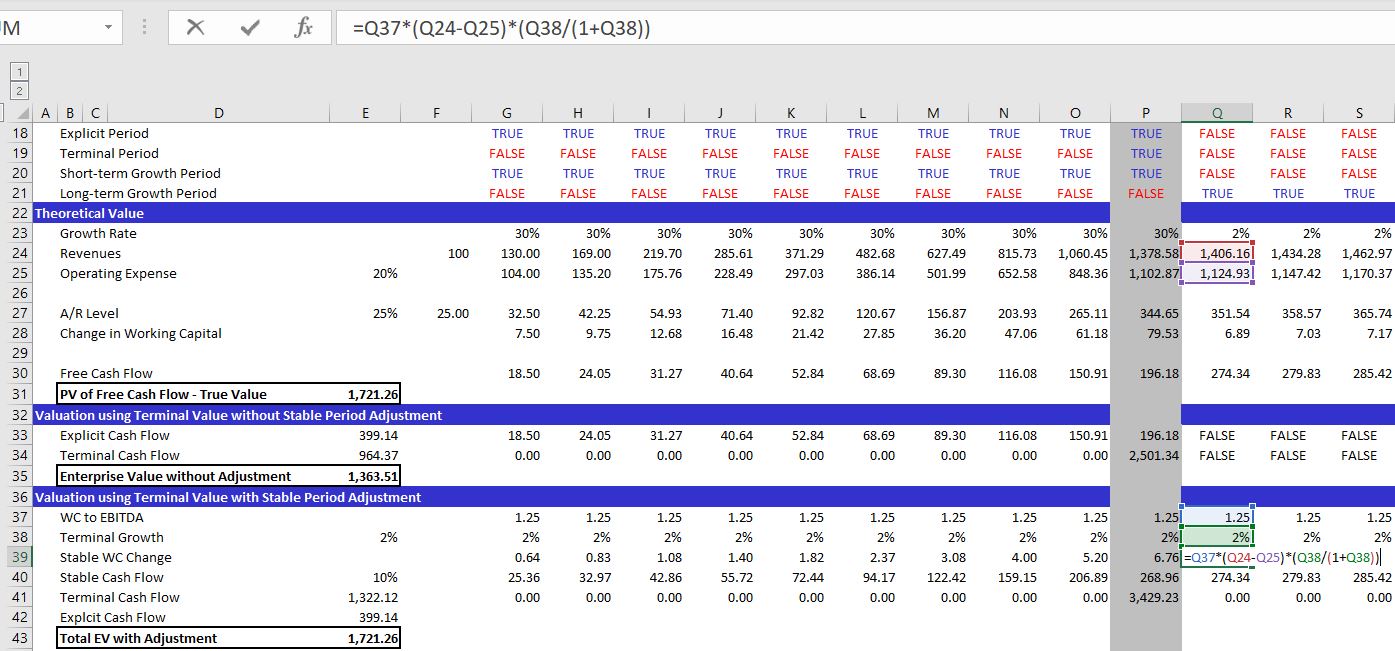

2017 current period. When you use the lower number for changes in working capital and then compute the net present value the result is consistent with the true theoretical number. Since the change in working capital is positive you add it back to Free Cash Flow.

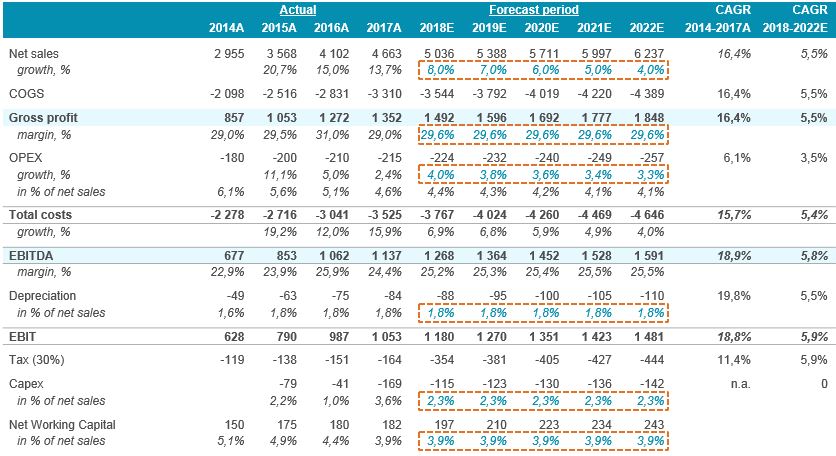

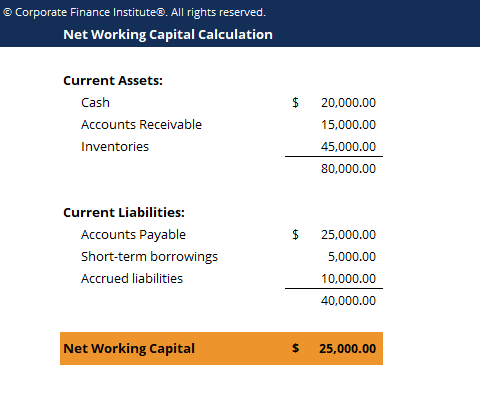

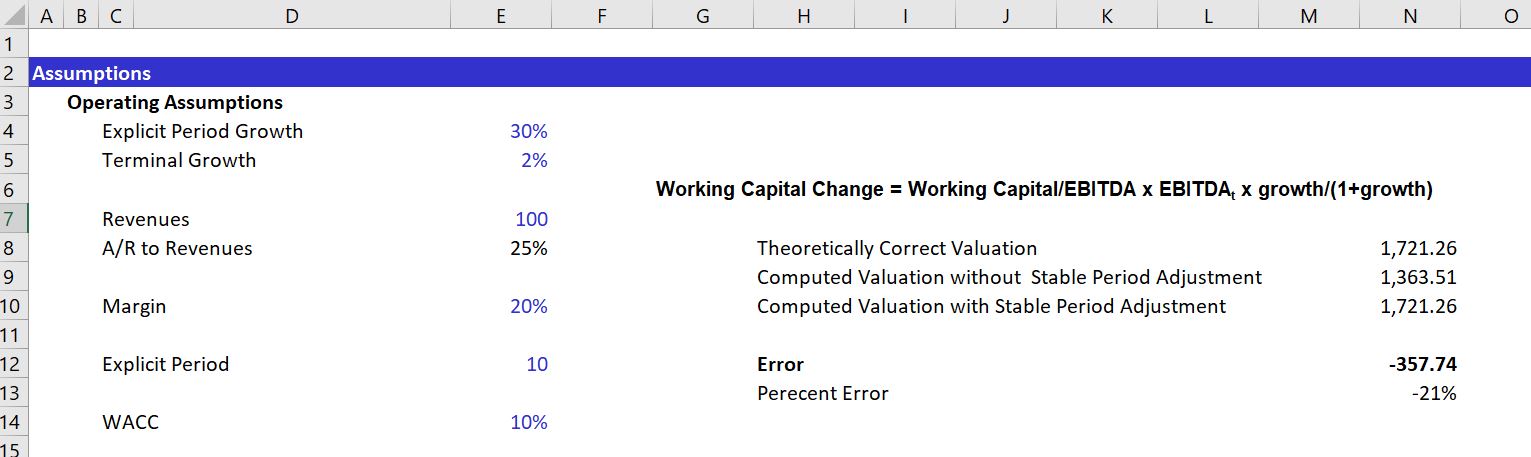

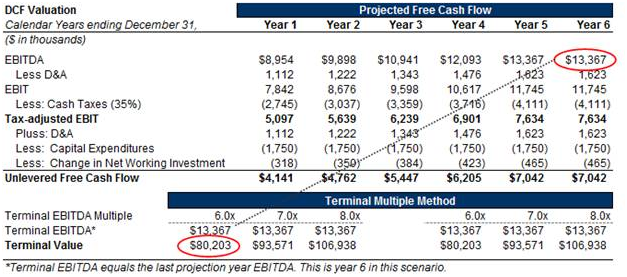

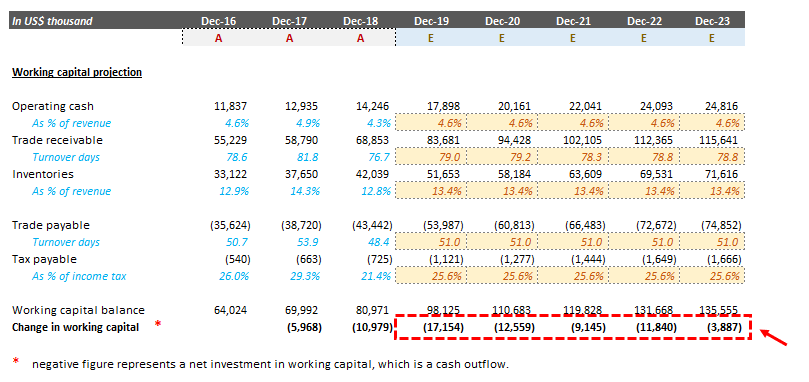

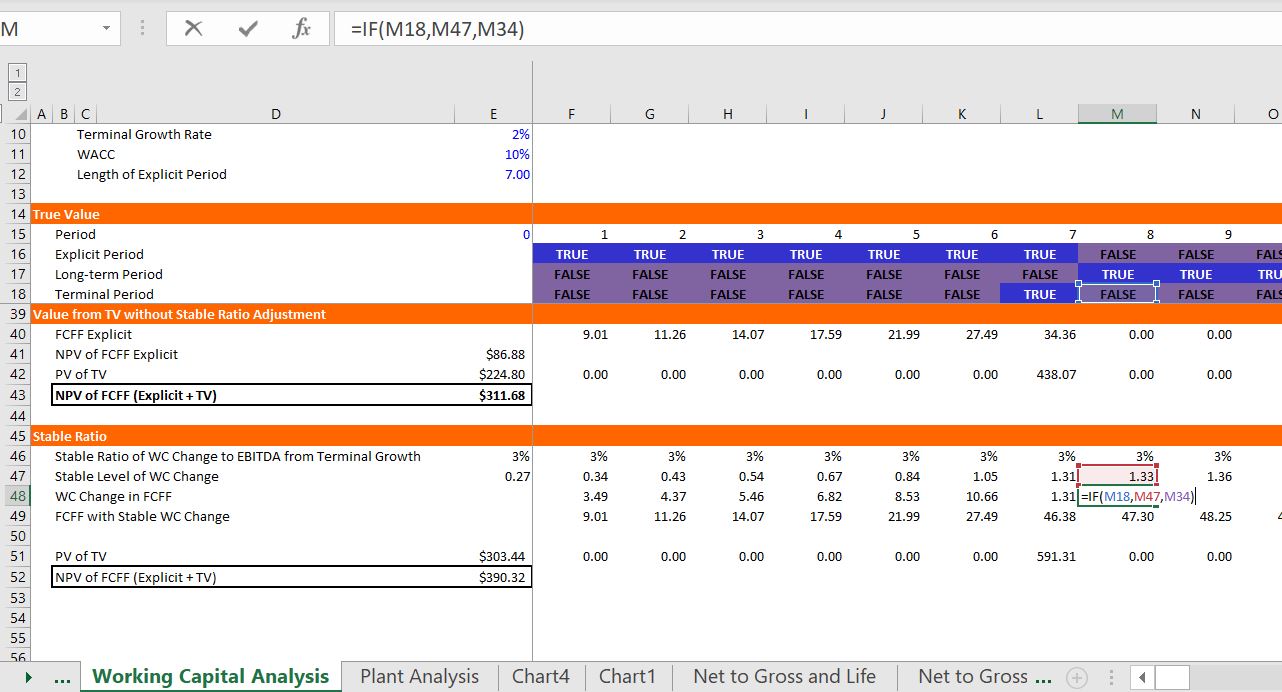

Net Working Capital Current Assets Current Liabilities. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth will also remain at the same level perpetually which is definitely not the case when the growth rate drops to 3 at 93 growth changes in working capital is 118k. Operating Assets DCF WACC - Working Capital.

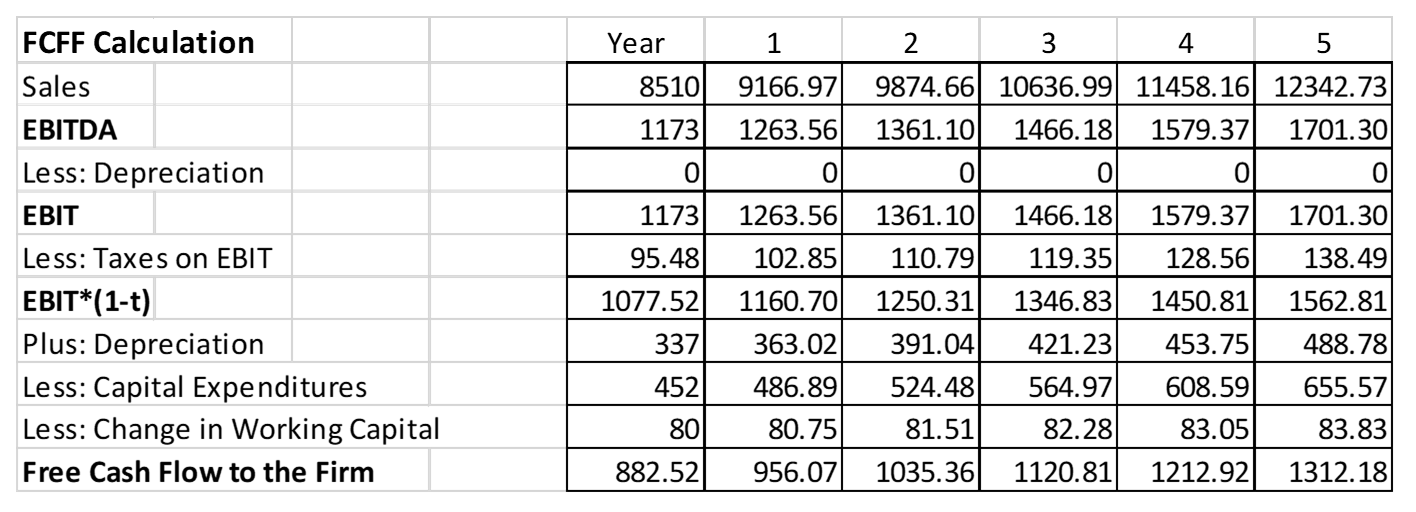

Calculate the change in working capital. 1173 x 1772 126356 x 1772 1361 x 1772 146618 x 1772 157937 x 1772 170130. First we have to address a primary assumption on what the DCF is measuring.

Lets start with the numbers - revenue is up 100. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period. Stable Terminal Cash Flow in DCF Working Capital Taxes and ROIC.

Change in Net Working Capital 5000. All else held constant this results in net income up 60 assuming a 40 tax rate. Moving to cash flow statement - net income is up 60 but change in working capital is a 100 outflow increase in AR resulting in a 40 decline in cash.

Once this is established your question can be answered. Thus the value of working capital in 2021 comes out to be -9972000000. Determine whether the cash flow will increase or decrease based on the needs of the business.

Answer 1 of 6. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC. Step 4 Capital Expenditures.

Here is an example of the calculations. Free cash flow decreases. Change in Net Working Capital 12000 7000.

The changes in working capital are discounted using the WCSales ratio working capital over sales which in this case is 80 8510 094. The formula for working capital is current operating assets minus current operating liabilities. The entire intuition behind CA-CL is to arrive at how cash has changed over the period increases in CA use of cash increase in CL source of cash--in that sense you would use non-cash CA - CL to get to FCF to do your DCF.

In this case the change in working capital is computed using the formula above and it is dramatically less. Thus the formula for changes in non-cash working capital is. Net Working Capital Formula.

The Change in Working Capital gives you an idea of how much a companys cash flow will differ from its Net Income ie after-tax profits and companies with more power to collect cash quickly from customers and delay payments to suppliers tend to have more positive Change in Working Capital figures. Under ordinary operating conditions many if not most companies have positive working capital current assets exceed current liabilities so forecasted increases in revenues require additional working capital investments and free cash flow is reduced all else held constant. Thats why the formula is written as - change in working capital.

Since the change in working capital is positive you add it back to. This indicates that the firm is out of funds. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC.

Free cash flow decreases. In 3-statement models and other. AP accounts payable.

Change in Net Working Capital is calculated using the formula given below. There are a few different methods for calculating net working capital depending on what an analyst wants to include or exclude from the value. Change in a net working capital change in current assets current assets current Working capital is defined as current assets minus current liabilities and for this blog we are assuming that the subject company utilizes an accrual basis of accounting.

Deduct the debt of last year to find the net asset value. Change in Working capital does mean actual change in value year over year ie. Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts receivable.

Working capital increases. The goal is to. Here you can see the value comes out to be negative.

Change in Net Working Capital 5000. 2016 prior period. Net Working Capital Current Assets less cash Current Liabilities less debt or.

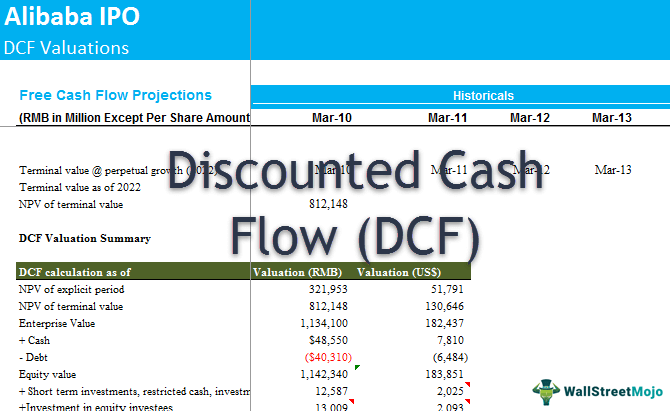

Add or subtract the amount. Valuation depends upon whether the DCF is valuing cash flows to operating assets or cash flows to. It means the change in current assets minus the change in current liabilities.

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Net Working Capital Nwc Formula And Calculator

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Change In Net Working Capital Nwc Formula And Calculator

Valuating A German Business Case Adidas Grin

Net Working Capital Template Download Free Excel Template

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Working Capital Video Tutorial W Excel Download

Discounted Cash Flow Analysis Street Of Walls

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Change In Net Working Capital Nwc Formula And Calculator

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Explaining The Dcf Valuation Model With A Simple Example

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance